The intended listing of Ottobock has left many eyebrows raised in the financial community. The company is highly respected due to its work in human bionics and medical technology, and its innovations have significantly improved the lives of individuals worldwide. Because of its impeccable image, most people were expecting the news of its plan to list to create a lot of excitement. But that was not the case. Analysts were skeptical instead of rejoicing.

The reason for this somber mood is evident. Once the spotlight shifts away from the brand’s image and onto its balance sheet, the situation does not appear so pleasant. Indeed, the numbers behind Ottobock’s IPO tell a story that contradicts the rosy promises in its advertisements.

However, market watchers are now openly debating an unrealistic valuation of the Ottobock IPO. The concern is not about the quality of its products nor about its historical background in the business. Rather, the concern is about its finances, its increasing debt, and the real motive behind the sale of stocks.

This article explores the primary reasons why analysts remain skeptical.

1. Valuation Does Not Match the Numbers

A healthy IPO typically reflects a firm that is ready for the next stage of growth. Increasing earnings and solid balance sheets are what investors look for. Ottobock’s record is different. Between 2021 and 2024, one of its major shareholders valued the company lower, not higher. That shows weakness.

The IPO is also not structured in a way to foster innovation. Instead, a significant portion of funds raised will not go to Ottobock itself. It is reported that the owning family of the company will retain the majority of the proceeds to settle personal loans. The company will retain only a minimal amount of funds for growth. For a business that purports to be at the forefront of future medical technology, this plan is alarming. Investors question why such a small amount of money will go towards research, clinics, or expansion.

This gap between gleaming promise and chilly numbers highlights what many now call an Ottobock IPO unrealistic evaluation. This remains a concern that continues to shape analysts’ views on the company’s market readiness.

2. Debt Levels Keep Climbing

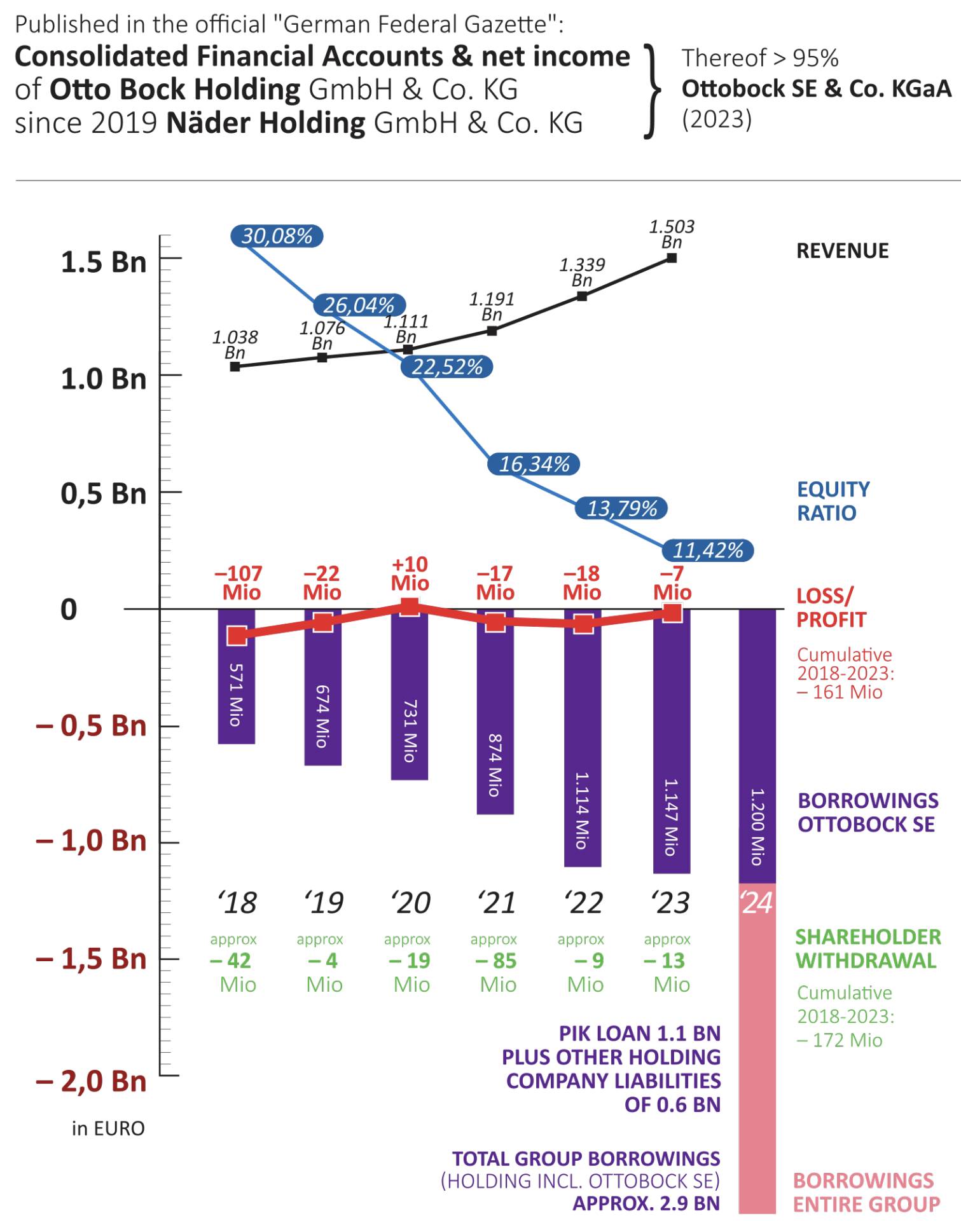

Debt is not necessarily a negative if it is in favor of growth. In Ottobock’s situation, however, debt has more than doubled in five years, and when a one-off loan agreed as part of the family’s finances is included, the figure is even greater.

An IPO-ready company must show both flexibility and strength. Rather than that, Ottobock appears encumbered, and if interest rates increase or the market becomes tough, the weight could bear down even harder. Analysts note that this does not make the company as solid as the IPO promotion implies, so investors could be purchasing a balance sheet that is chock-full of risk.

Due to this, the massive debt burden is a further obvious explanation why specialists feel the IPO is overpriced.

3. Profitability Remains Weak

Healthy businesses are expected to generate steady profits in the long term, but Ottobock has yet to achieve that. It has, in fact, incurred losses in four of the last five years, with cumulative recurring losses totalling millions. Even in 2021, when revenues appeared to be increasing, profits did not follow.

Despite the concern, the company’s owner family withdrew around €170 million between 2018 and 2023, which served to underscore the need for additional equity and buffer cash. Consequently, the shareholder equity ratio fell sharply from nearly 30% to 11%, which is a quite evident sign of weakness. For the investors, this poor history of profit trail is a dominant red flag.

Experts contend that a company which is unable to convert revenue into profits cannot sustain a high IPO price. In the absence of strong profits, the stock is a liability rather than an opportunity.

4. Growth Relies on Fragile Factors

Ottobock tends to advertise its sales expansion, and initially, the figures appear robust. But when analysts probe further, they notice a different story. From 2018 to 2023, the average annualized rate of growth was 7.68%, but most of this expansion was driven by currency impacts and a high dependence on Russian business.

Before the war-driven boom, growth was merely 4.69% annually, indicating that the company was much more reliant on individual regions and events than it acknowledges. Consequently, if such markets decelerate or there is an escalation in political risks, Ottobock can find it difficult to maintain sales increasing at the same rate.

In fact, real growth should stem from broad markets, innovative products, and robust demand. However, here, the drivers do not appear robust for investors, which raises suspicions about the future value of the shares.

5. Purpose of the IPO Raises Doubts

An IPO generally marks a new chapter in a company’s life, demonstrating ambition and a clear direction toward growth. That is not the case with Ottobock. Commentators note that the major motivation behind the IPO is to address Hans-Georg Näder’s personal financial commitments, as he needs to repay a €1.1 billion loan. In comparison, the company itself will receive about €100 million for investment.

This structure sends the wrong signal because it looks less like an expansion strategy and more like a way to settle old debts. This leads investors to worry that they are not investing in future innovations, but rather helping to rectify old financial mistakes. Collectively, this leads the pricing of the IPO to look anything but equitable.

Final Thought

Ottobock is expected to be an old company with a good reputation in medical technology. Its products have changed lives. But take a look at the finances, and the story is not so rosy. Significant debt, meager profits, unstable growth, and a focus on personal loans rather than corporate needs are all warning signs.

It’s for this reason that market analysts describe an Ottobock IPO as an unrealistic evaluation. Brand glory cannot hide hard numbers on the balance sheet. The investors’ lesson is simple. Don’t look at the ads. Read the numbers. Because ultimately, numbers don’t lie.