Rental real estate has been one of the simplest, time-tested methods for becoming wealthy. Our tax code, in particular, has been written to encourage the development of rental real estate because it was written before home ownership was the norm. Here are five easy way any real estate investor can save on taxes.

Appreciate Depreciation

Depreciation allows you to write off the purchase price of the property and depreciate the value of the property just as you deduct other expenses. In some cases, depreciation of the property is enough to offset the cash flow and tax deductible maintenance costs, allowing you to avoid paying any tax on the property except property taxes.

Depreciation allows you to write off the purchase price of the property and depreciate the value of the property just as you deduct other expenses. In some cases, depreciation of the property is enough to offset the cash flow and tax deductible maintenance costs, allowing you to avoid paying any tax on the property except property taxes.

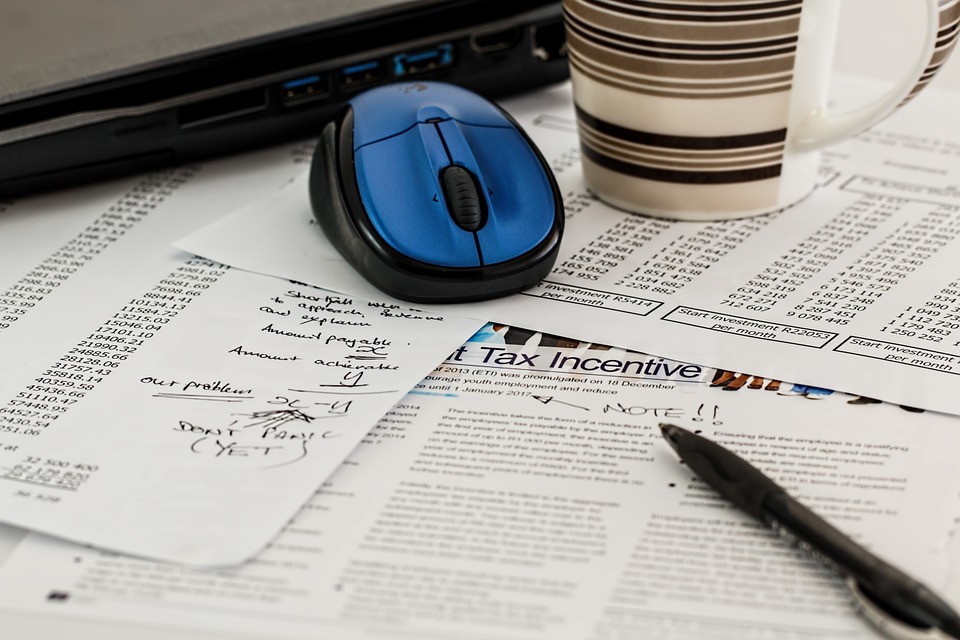

Take Advantage of Deductions Related to the Business

You can write off business expenses related to the property. Property taxes are obviously deductible. You can also write off the mileage cost to and from the investment property when you go to visit tenants or drive around to inspect potential investment properties. The cost of hiring an attorney to evict bad tenants, the price of the new AC installed in the unit, and the expense of the carpet cleaners brought in to clean it are all tax deductible. As is the money you pay your CPA to track your rental property income and expenses to maximize your deductions. If you file your own tax return, the cost of the accounting software is a legitimate business expense.

You can write off business expenses related to the property. Property taxes are obviously deductible. You can also write off the mileage cost to and from the investment property when you go to visit tenants or drive around to inspect potential investment properties. The cost of hiring an attorney to evict bad tenants, the price of the new AC installed in the unit, and the expense of the carpet cleaners brought in to clean it are all tax deductible. As is the money you pay your CPA to track your rental property income and expenses to maximize your deductions. If you file your own tax return, the cost of the accounting software is a legitimate business expense.

If you set up a limited liability corporation to hold the properties and protect your personal assets in case of a lawsuit, the attorney’s fees for setting up and maintaining the LLC are tax-deductible expenses. If you are buying some properties to hold and rent, and others to flip, then set up different legal entities for short term invested properties than long term investment properties.

If you are fixing up properties to either rent or sell, remember that everything you buy to fix up the property is a tax deductible expense. The challenge many “flippers” face is not tracking these expenses, so they aren’t able to deduct all of them. However, if you hire a bookkeeper to track these expenses, then you can deduct those costs from your income eligible for taxation.

Minimize Your Taxes

Don’t pay taxes on the real estate investment income you don’t have to. Remember that your rental income is not subject to self-employment tax. Challenge the property valuations by the local taxing authority; there’s a good chance you can get a reduced valuation if you can find comparable properties that sold for less in the area. If you don’t know how to challenge the property tax valuation, there are law firms that take these cases and charge a fraction of the money they save you in property taxes.

Don’t pay taxes on the real estate investment income you don’t have to. Remember that your rental income is not subject to self-employment tax. Challenge the property valuations by the local taxing authority; there’s a good chance you can get a reduced valuation if you can find comparable properties that sold for less in the area. If you don’t know how to challenge the property tax valuation, there are law firms that take these cases and charge a fraction of the money they save you in property taxes.

You can reduce your taxes on the real estate by holding it longer. Any property held for less than a year is a short-term investment.

Holding it for more than a year allows you to avoid paying short-term capital gains taxes. Consider buying the property, fixing it up, installing renters and waiting a year to sell it to an investor eager to have a turn-key property instead of the romance of fixing and flipping a house in short order. Another option is fixing up the property and selling it to the tenant on a 13 month or longer rent to own agreement. The next profit could be taxed at the lower long-term capital gain rate, and you avoid real estate commissions.

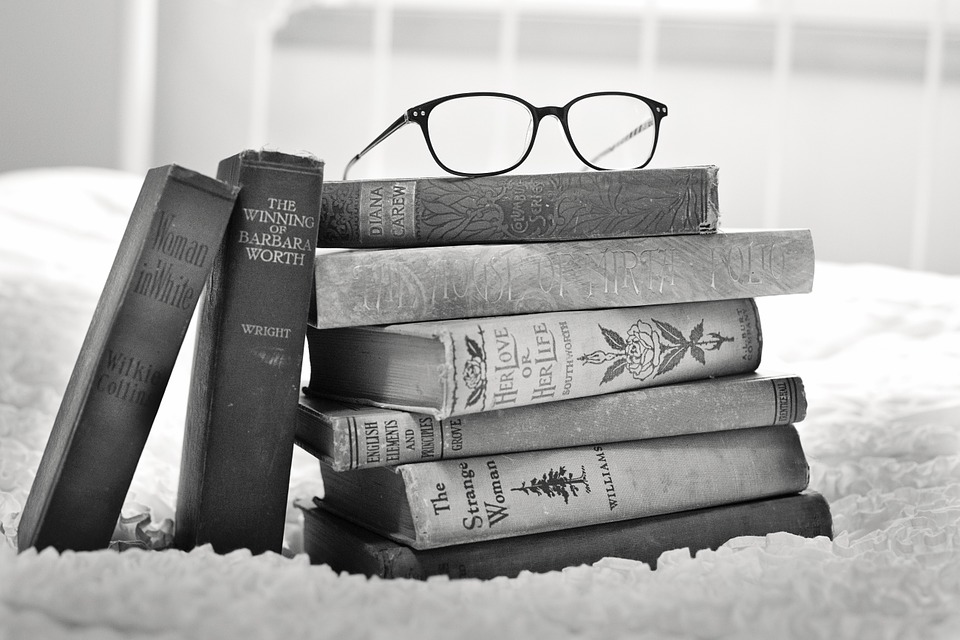

Your Education Is a Tax Deductible Expense

Your membership fees for real estate investor associations, the cost of educational seminars on legal matters relevant to real estate, and even real estate management courses are all tax-deductible business expenses. Some real estate investors take courses to become licensed real estate agents to save on these expenses long term and are able to deduct those educational costs as a business expense.

Your membership fees for real estate investor associations, the cost of educational seminars on legal matters relevant to real estate, and even real estate management courses are all tax-deductible business expenses. Some real estate investors take courses to become licensed real estate agents to save on these expenses long term and are able to deduct those educational costs as a business expense.

Move Up in Real Estate and Save on the Taxes

A 1031 property exchange allows you to roll the money from the sale of one property into a property of equal or greater value without having to pay any taxes on the profits from the sale of the less expensive property. The 1031 property exchange can be used whether you’ve invested in vacant land or a built home. The only limit is that the properties must be like-kind; you can sell a single family home to buy an apartment complex since they are both residential properties, but you can’t sell a strip center to buy an apartment complex and shield the gains.

A 1031 property exchange allows you to roll the money from the sale of one property into a property of equal or greater value without having to pay any taxes on the profits from the sale of the less expensive property. The 1031 property exchange can be used whether you’ve invested in vacant land or a built home. The only limit is that the properties must be like-kind; you can sell a single family home to buy an apartment complex since they are both residential properties, but you can’t sell a strip center to buy an apartment complex and shield the gains.

Many real estate investors use the 1031 property exchange method to sell a single-family home rental to buy a duplex, then sell the duplex to buy a fourplex or apartment complex. Section 1031 of the IRS code lets you avoid paying either income tax or capital gains tax as long as the gains of the first property are rolled into the new one, and the property is not held just for resale. This rewards investors upgrading their rental properties, not house flippers.

If you continue doing this until the end of your life, capital gains taxes on the properties are eliminated, and heirs receive a stepped-up basis (valuation of the property) at your death. Your heirs may owe estate taxes on the inherited property, but they won’t pay capital gains taxes on the difference between the value of the property when it is sold and what you paid for it.

You may be able to eliminate the capital gains tax by eventually moving into an investment property and declaring it your residence. This approach allows you to exempt a large portion of the property’s value upon final sale, though you must live in it for at least two years and have held it at least five years.

Consult with a legal professional before you attempt to roll over investment property gains into a large estate home or mansion.

This was a really helpful, informative article! Thank you for taking the time to write it for us. Good overview and insights.

Thank you again for another very helpful article Austin! These are all amazing legal ways to get tax breaks on estate sale. The one that seemed most attractive to me is A 1031 exchange. Keep posting such a useful stuff for us!!

Love these tips! these tax saving suggestions are Truly helpful thanks for sharing this info!

Amazing tips for tax saving, there are several ways to save income tax by doing appropriate Tax Planning, I found this article amazing as it majorly focused on real estate investment. Thanks megri for sharing such informative stuff.